Disability Discussion

Why Is Your Income Your Greatest Asset?

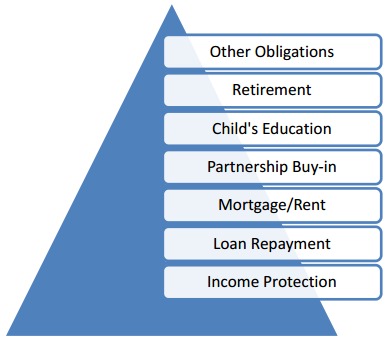

From our experience most young physicians have the same financial concerns: income protection, loan repayment, mortgage/rent, partnership buy-in, child’s education, retirement, and other obligations. All are considerable obligations and to meet these obligations requires your ability to work. If you cannot, you should have disability insurance to replace what you have lost. It could be difficult as a young physician to contemplate being faced with an injury or illness so severe that it changes the course of the career you’ve worked so hard to establish. That is why disability insurance should be considered an important component of a comprehensive financial plan.

to request more information or please call us at 484-686-0200

| Age | $150,000 | $200,000 | $250,000 | $300,000 | $350,000 | $400,000 | $500,000 |

|---|---|---|---|---|---|---|---|

| 30 | 5,250,000 | 7,000,000 | 8,750,000 | 10,500,000 | 12,250,000 | 14,000,000 | 17,500,000 |

| 35 | 4,500,000 | 6,000,000 | 7,500,000 | 9,000,000 | 10,500,000 | 12,000,000 | 15,000,000 |

| 40 | 3,750,000 | 5,000,000 | 6,250,000 | 7,500,000 | 8,750,000 | 10,000,000 | 12,500,000 |

| 45 | 3,000,000 | 4,000,000 | 5,000,000 | 6,000,000 | 7,000,000 | 8,000,000 | 10,000,000 |

Why should a physician purchase an Individual Disability Insurance policy? Assuming you are 32 years old and your current income is $200,000:

We know that you have spent the last 14 years becoming an attending physician. We know that if you practice to age 65 your potential income is $6,600,000.00. It is probable that you have substantial student loans. Taking into consideration the time you have committed, your income potential and the obligations you have assumed, it is imperative to purchase a comprehensive individual disability policy.

When should a physician purchase an individual disability policy? The answer is NOW! Why? Take advantage of your good health so you have no difficulty qualifying for a policy. Lock in your premium at your current age. Once disability insurance is purchased, your premium will not increase unless you purchase additional insurance, as your income increases.

Can Residents/Fellows purchase individual disability insurance if their current employer provides group disability? Yes. Most companies have special issue limits for Residents and Fellows. No income documentation is required and your group disability benefit is not used in the calculation of how much individual disability insurance you can purchase.

What can you expect the premium to be? Individual disability insurance policies typically cost 2% of current income.

How long does the application process take? The application process usually takes 4 – 6 weeks.

What are the steps in the application process? Completion of application

Paramedical exam

Personal history interview

Who owns the disability policy? You do.

Is the disability policy portable? Yes. Since you own the policy, if you move to another state, the policy moves with you. You just need to notify us of your new mailing address.

Will you be able to obtain coverage if you have a pre-exsisting condition? Yes. Depending on the medical condition, most carriers can still offer you some type of coverage. For many medical conditions a policy can be issued with an exclusion for the medical condition. An exclusion allows the carrier to provide coverage except for a disability which occurs from that pre-exsisting, medical condition. We represent many carriers and there is most likely a carrier that will be willing to make an offer.

What can you expect the premium to be? Individual disability insurance policies typically cost 2% of current income.

What can you expect the premium to be? Individual disability insurance policies typically cost 2% of current income.